What is Shareholding Structure and Why It Matters

Shareholding structure, also known as ownership structure, provides a detailed view of how a company's equity is divided among its shareholders. This information serves multiple critical functions in business verification and compliance processes.

The importance of accurately understanding shareholding structure extends beyond simple record-keeping. Organizations must comply with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations, which mandate the identification and verification of Ultimate Beneficial Owners (UBOs). Additionally, shareholding structure analysis helps assess business relationship risks by revealing connections to Politically Exposed Persons (PEPs) or individuals with adverse media coverage.

The KYB process requires gathering comprehensive information about a company's shareholding structure through official documents including articles of incorporation, shareholder registers, annual reports, and independent research verification.

Types of Shareholding Structures in Business

Different business entities exhibit various shareholding structure patterns. Understanding these common types helps streamline the verification process:

- Sole Proprietorship: Single-owner structure with complete control and liability

- Partnership: Shared ownership between two or more individuals or entities

- Limited Liability Company (LLC): Flexible structure combining corporation and partnership benefits

- Corporation: Formal structure with shareholders, board of directors, and officers

- Public and Private Companies: Distinguished by share trading accessibility and disclosure requirements

Each shareholding structure type presents unique challenges and opportunities for compliance teams conducting thorough business verification.

Identifying Beneficial Owners Through Shareholding Structure Analysis

Beneficial owners represent individuals who ultimately own or control a legal entity, regardless of whether they appear as legal shareholders on record. These individuals exercise significant influence over company operations and decision-making processes.

Methods for Identifying Beneficial Owners

Company Registers: Most jurisdictions require companies to maintain detailed shareholder registers listing all individuals and entities holding company shares. These registers provide valuable shareholding structure information and stakeholder details.

Legal Documents: Articles of incorporation, bylaws, and shareholder agreements contain essential shareholding structure information, including shareholder rights and responsibilities.

Public Records: Corporate filings, regulatory disclosures, and court documents may reveal shareholding structure details through publicly accessible channels.

Due Diligence Questionnaires: Companies often require beneficial owners to complete comprehensive questionnaires gathering identity information, wealth sources, and potential conflict disclosures.

Third-Party Databases: Commercial databases and intelligence platforms aggregate shareholding structure information, providing valuable KYB process resources.

Navigating Complex Shareholding Structures

Complex shareholding structures present significant challenges for compliance teams. These arrangements frequently involve multiple entities, including holding companies, trusts, and various legal structures across different jurisdictions.

Direct vs. Indirect Ownership

Direct ownership occurs when individuals or entities hold shares directly in a company. Indirect ownership involves share ownership through intermediary legal entities such as holding companies or trusts. Understanding both ownership types is essential for accurate shareholding structure analysis.

Control mechanisms extend beyond simple share ownership. Individuals may exercise significant influence through voting agreements, board representation, or contractual arrangements, even without majority shareholdings.

Complex shareholding structures often involve networks spanning multiple jurisdictions, sometimes designed to obscure true ownership and control. These arrangements require enhanced due diligence and careful investigation.

Official Sources for Shareholding Structure Information

Government agencies and regulatory bodies maintain official company registries containing detailed shareholding structure information. These primary sources typically include shareholder names, respective shareholdings, and historical ownership changes.

Information availability varies across jurisdictions and registries. Some provide granular detail while others offer basic information. Accessing complete shareholding structure data may require consulting multiple official sources.

Cross-referencing official registry information with third-party data providers and publicly available financial reports ensures accuracy and completeness. This verification process helps identify discrepancies requiring further investigation.

Thorough verification is crucial for companies with intricate shareholding structures involving holding companies, trusts, or offshore entities. Triangulating data from various sources provides a comprehensive understanding while mitigating incomplete or outdated information risks.

Ongoing Monitoring of Shareholding Structure Changes

Shareholding structures evolve continuously due to ownership changes, control shifts, or business activity modifications. Regular monitoring and re-verification ensure ongoing compliance and risk mitigation.

Key Triggers for Re-verification

- Ownership Changes: New shareholders acquiring significant stakes or existing shareholders modifying their holdings

- Business Activity Changes: Company expansion into new industries, markets, or jurisdictions

- Corporate Events: Mergers, acquisitions, or other significant corporate transactions

- Gradual Shifts: Incremental changes that may eventually result in control modifications

Real-time monitoring systems help maintain current and accurate shareholding structure information, particularly important in dynamic business environments with frequent ownership changes.

Managing Complex Shareholding Structure Challenges

Complex shareholding structures require risk-based approaches and enhanced due diligence measures. This involves examining multiple ownership layers and cross-referencing information from various sources.

Investigation Strategies

Following ownership trails through successive tiers of holding companies, subsidiaries, and affiliated entities requires examining corporate records, shareholder registers, and relevant documentation to identify UBOs.

Special attention should focus on jurisdictions with limited corporate transparency regulations or tax haven locations that may obscure shareholding structures. These areas often present additional verification challenges.

Red flags indicating shell companies or illicit purpose vehicles include companies lacking discernible business operations, complex ownership trails leading to high-risk jurisdictions, or information inconsistencies.

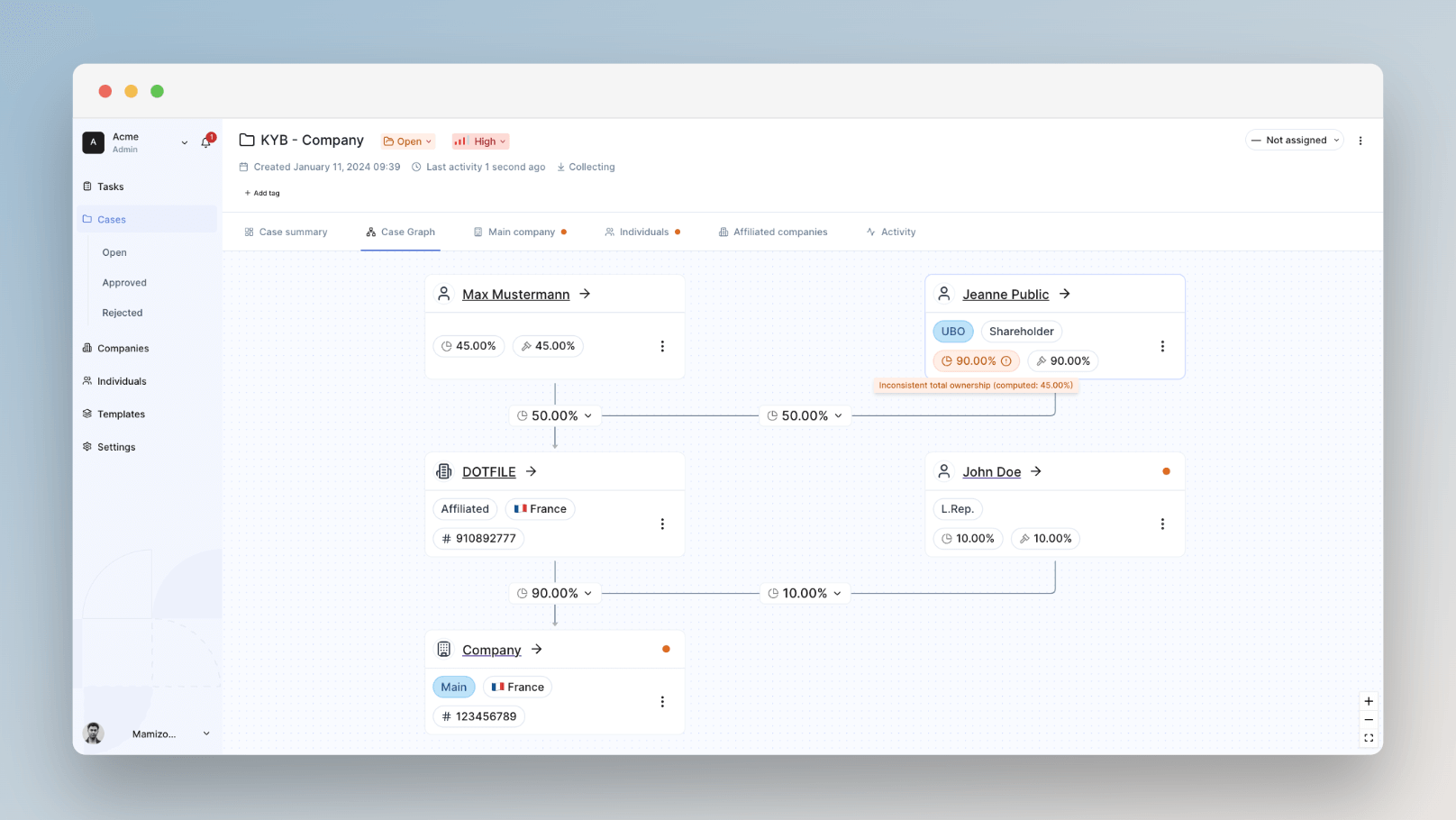

Comprehensive compliance solutions provide holistic views of complex shareholding structures. Visual representation tools like Case Graph help businesses understand ownership structures, including main companies, individuals, and affiliated entities.

The Importance of Accurate Shareholding Structure Identification

Failure to accurately identify the shareholding structure and UBOs can result in severe consequences, including hefty fines, reputational damage, and potential criminal charges. Regulators around the world have increased their scrutiny and enforcement of KYB and customer due diligence requirements, making it imperative for businesses to prioritize this aspect of their compliance programs.

By understanding the shareholding structure, businesses can better assess the risk associated with a potential client or business partner. This information helps identify any PEPs, individuals or entities subject to sanctions, or other high-risk individuals or entities that may be involved. Accurate shareholding information also aids in detecting potential conflicts of interest, related party transactions, and other red flags that could indicate money laundering, terrorist financing, or other illicit activities.

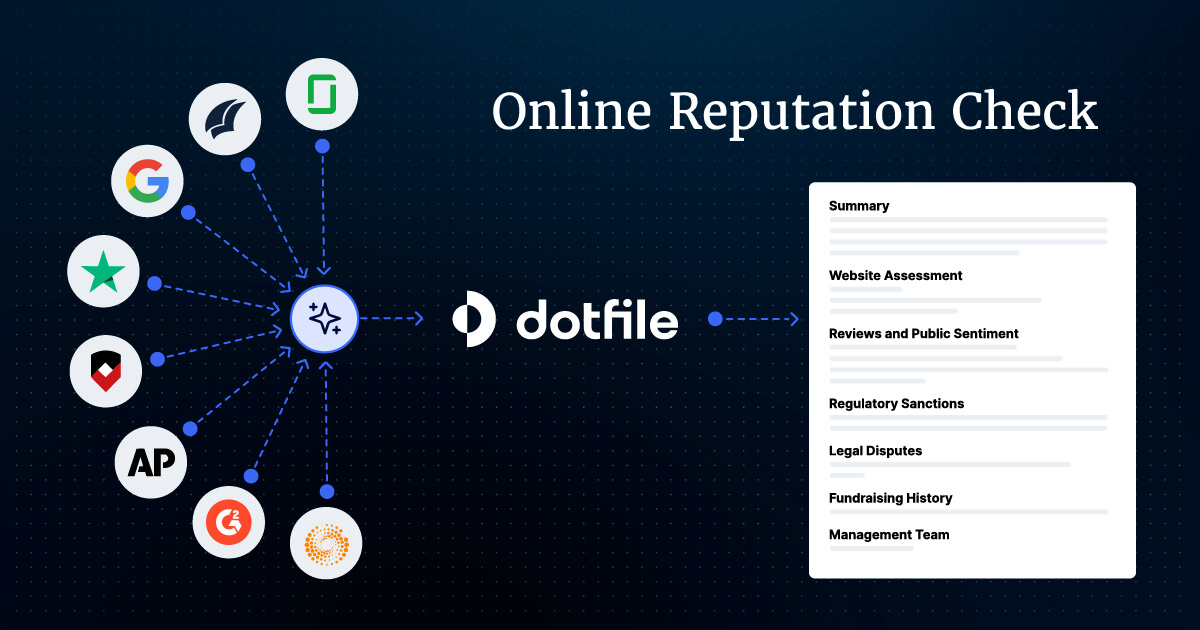

Dotfile’s end-to-end KYB platform streamlines all processes related to business verification, shareholding structure identification, and verification of UBOs and key stakeholders. Dotfile helps businesses streamline their compliance operations, reduce risk, and build trust. Book a demo to see how we can help you